Underwriting

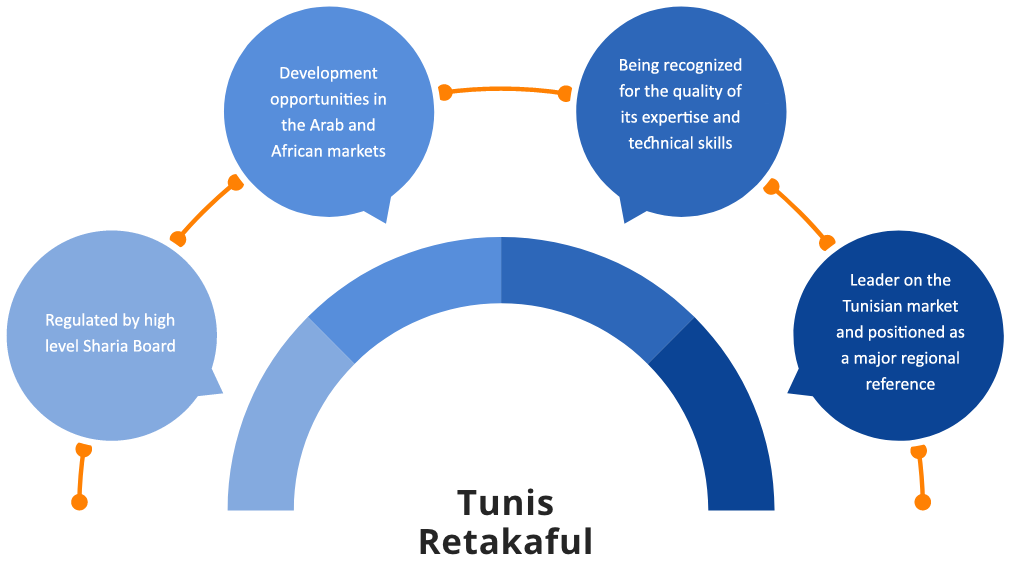

Tunis ReTakaful Window was created in January 2011 to offer a variety of shari’a compliant Retakaful products that meet the needs and requirements of Takaful operators.

Tunis ReTakaful is the first and only retakaful entity established and operating on the Tunisian market. Tunis Retakaful is licensed by the General Insurance Committee to provide comprehensive retakaful services.

The company conducts all its operations strictly in accordance with Sharia principles, as advised by its Sharia Supervisory Committee. It also appointed an independent Sharia auditor to ensure compliance with Sharia principles.

With over ten years of experience, our clients benefit from our underwriting expertise and an in-depth knowledge of takaful insurance. We are flexible to identify and implement Sharia-compliant solutions, which help our partners to be competitive in their target markets.

Our takaful model is a Combined Model – Wakala for underwriting and Mudharaba for investment.

Shariaa Advisor : Mr Mohammed Anouar Gadhoum

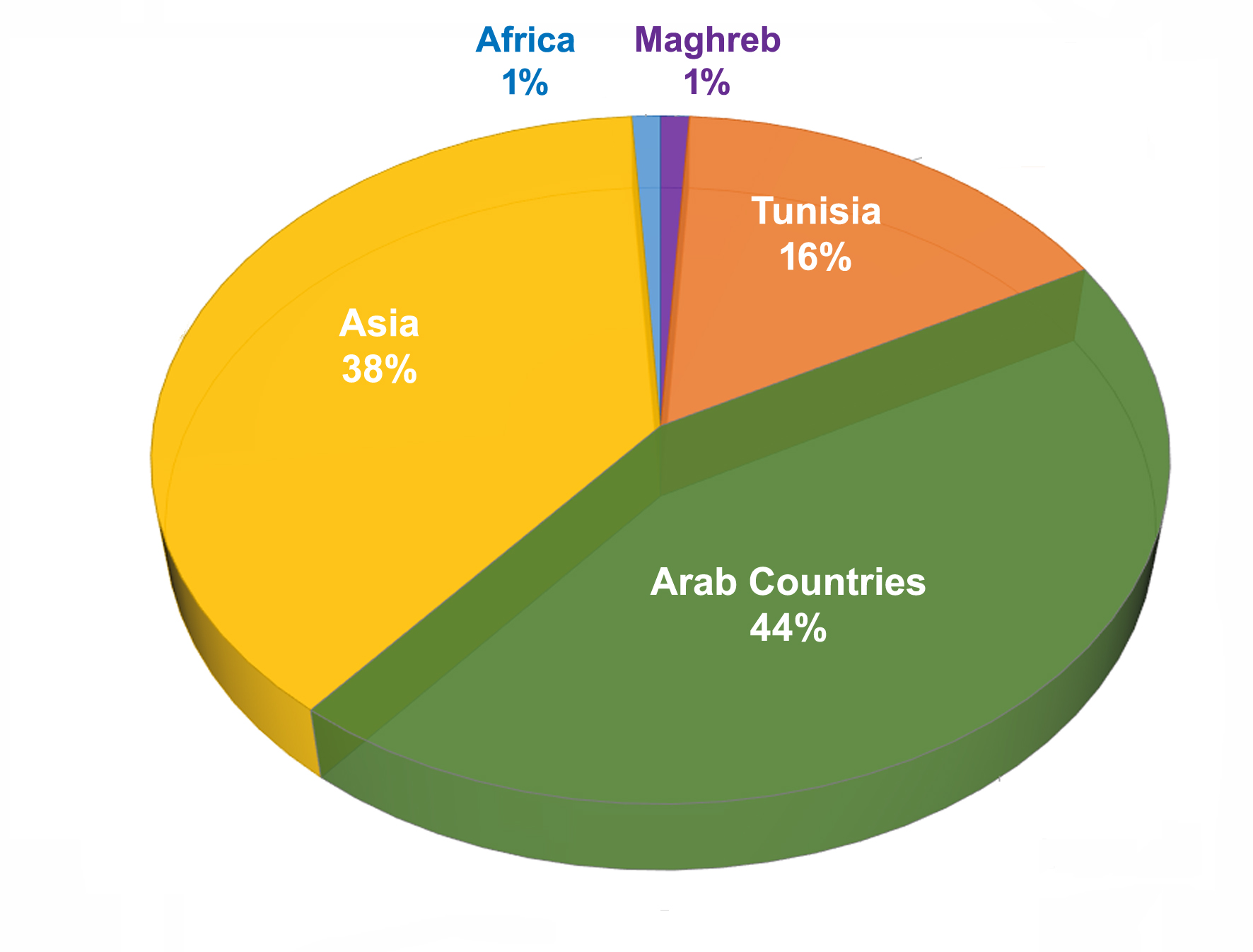

Territorial scope (2024)

- Tunisia

- Arab countries

- Maghreb

- Africa

- Asia

Underwriting Capacities

| TUNISIA | ETRANGER | |

|---|---|---|

| Non Marine (Incendie, Eng & ARD) |

10,000,000 TND / Traité | 2,500,000 US$ / Traité |

| Marine | 2,500,000 TND / Traité | 3,000,000 US$ / Traité |

| Vie | 2,500,000 TND / Traité | 1,000,000 US$ / Traité |

| RC & RC Professionnelle |

3,000,000 TND / Traité | 1,000,000 Usd / Traité |

Treaty capacities

Facultative capacities

| TUNISIE | ETRANGER | |

|---|---|---|

| Non Marine (Incendie, Eng & ARD) |

60,000,000 TND / Risque | 12,000,000 US$ / Risque |

| Marine | 10,000,000 TND / Risque, Police & Ou Expédition | 3,700,000 US$ / Risque, Police & Ou Expédition |

| Energie | 20,000,000 TND / Risque | 6,000,000 US$ / Risque |

| Vie | 2,500,000 TND / Risque | 1,000,000 US$ / Risque |

| RC & RC Professionnelle |

3,000,000 TND / Risque | 1,000,000 US$ / Risque |