FIDAC: Fund for the Compensation of Agricultural Damages caused by Natural Disasters

The 2018 Finance Law, under the Law No. 66 of 18 December 2017, created a special fund to compensate agricultural damages caused by natural disasters. These include mainly storms, floods, ice, droughts, wind and snow which are not covered by the standard insurance contract provided by insurance companies. The objective is to protect and develop farmer’s resources to cope with climate change. The fund is financed by an annual state contribution of around 30 million dinars, a solidarity tax of 1% of direct and indirect income in the agricultural sector, and a membership contribution of 2.5% of the farmers’ or fishermen’s production costs or the estimated value of production, depending on their choice. The management of the fund has been attributed to the Tunisian Agricultural Mutual Insurance Company CTAMA.

Natural Disasters

A survey has been launched on Natural Catastrophes in Tunisia. The Tunisian government, with the support of the World Bank, is committed to develop and implement a standardised and institutional framework for the management and financing of natural disaster risks in Tunisia.

Tunis Re closed the year 2023 with a notable improvement in its turnover and an achievement or even an exceeding of the annual forecasts relating to it.

The Consolidated Gross Written Premiums as of December 31, 2023 amounted to 222.533 M.TND.

Our strategy of selective and diversified development is once again relevant in these results, with the maintenance of a relationship based essentially on trust and continuous communication with our partners, our commercial efforts and the continuous improvement of our underwriting policy and conditions, as well as the conquest of new profitable business and our presence on a multitude of markets presenting important development opportunities.

Tunis Re’s investments, which include financial, monetary and real estate investments and deposits with cedants, totalled 510.872 M.TND at the end of the year, up 2% compared to the previous year.

In a demanding context, marked by a disturbed economic climate both at the international and national levels, Tunis Re continues to achieve very good performances.

Indeed, Tunis Re has well demonstrated its ability to absorb shocks and to perform even in a very tense macroeconomic and geopolitical environment, confirming once again its resilience and the pursuit of its mission.

Thus, the year 2023 was closed with a profit of 18.578 M.TND.

At the end of 2023, the company remains well capitalised with a solvency ratio of 151% and an improving profitability measured by the ROE ratio which showed a rate of 8.2%.

These good results testify to the important work done by Tunis Re’s teams, its good financial health, its capacity to generate value even in a difficult environment and its sustainable and profitable growth approach.

Combined Ratio 92.7%

Total assets 246.463 M.TND

ROE 8.2%

Net Result 18.578 M.TND

IFRS STANDARDS

Tunis Re has started in 2020 the implementation of the International Financial Reporting Standards (IFRS) standards, and from 2021 will be issuing the financial statements under the IFRS standards as required by the article 1/2020 of June 19, 2020 of the General Insurance Committee.

Progress in the IFRS/IAS implementation project:

Tunis Re, continues to make active progress while meeting the regulatory deadlines attributed to the work and preparations for the implementation of IFRS.

Indeed, today, Tunis Re has succeeded in closing and certifying the restatements of the 2020 and 2021 financial years in IFRS4, for those of 2022 they are in the process of certification and we will soon begin the restatement work for the 2023 financial year, which includes all actuarial and accounting restatements related to the IFRS17 standard.

To download the financial information please click here.

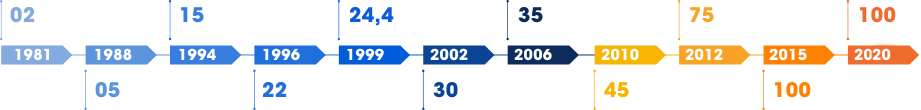

Thanks to its good performance, Tunis Re has been able to increase its capital from 2 million of Tunisian Dinars when established to the actual level of 100 million Dinars”.

The Shareholders

| Shareholding structure in % of the capital | |

|---|---|

| Tunisian State | 5 |

| Insurance & Reinsurance Companies | 55 |

| Banks | 26 |

| Others (Tunisia stock exchange) | 14 |

Evolution of the share capital in MDT